Federal Reserve (Fed) ka interest rate decision, jo ke "Fed Rate Decision" ke naam se jaana jaata hai, ek aham economic event hai. Ye decision darasal Fed ki monetary policy ka ek hissa hai. Main yahan aapko Fed Rate Decision ke baare mein roman Urdu mein tafseelat bata raha hoon:

- Fed Rate Kya Hai:

- Federal Reserve (Fed) apni monetary policy ke teht interest rates ko control karta hai. Interest rates ko modify karke, Fed economy ko regulate karta hai.

- Interest Rate Decision Ka Asar:

- Jab Federal Reserve apne interest rates mein kisi bhi tarah ki tabdeeli karta hai, toh iska seedha asar financial markets, including currency exchange rates, stock markets, aur bond markets par hota hai.

- Hukumat aur Businesses Par Asar:

- Interest rate decision ka seedha asar hukumat aur businesses par hota hai. Low interest rates se loans hasool karna asaan ho jata hai, jo ki economic activity ko boost karta hai. High interest rates se borrowing mushkil ho jata hai, lekin inflation ko control mein rakhne mein madad karta hai.

- Inflation Control:

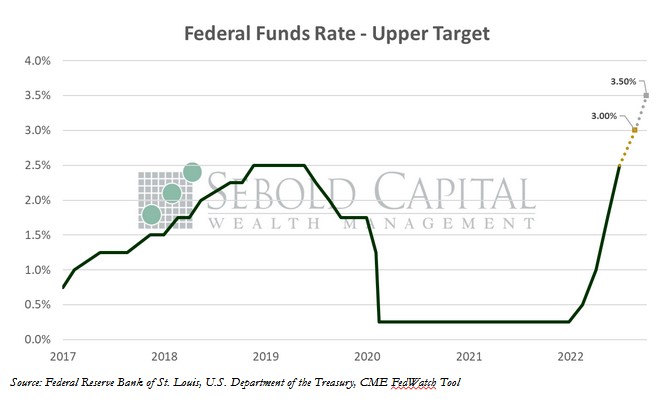

- Fed apne interest rate decisions ke zariye inflation ko control mein rakhne ki koshish karta hai. High inflation ko rokne ke liye interest rates ko badhaya jata hai.

- Unemployment:

- Interest rate decisions ka ek aur maqsad unemployment ko control karna hota hai. Economic activity ko badhane ke liye Fed interest rates ko kam kar sakta hai.

- Market Expectations:

- Market participants, jaise ki traders aur investors, Fed Rate Decision ka behtareen expect karte hain taki woh apne trading aur investment strategies ko adjust kar sakein.

- Press Conference:

- Usually, Fed Rate Decision ke announcement ke baad Fed Chair ek press conference bhi karta hai, jismein current economic conditions aur future policy ke baare mein details di jaati hain.

- Currency Markets Par Asar:

- Fed Rate Decision currency markets par bhi asar dalta hai. Agar interest rates increase hote hain, toh woh currency ke liye positive sign ho sakta hai, lekin stock markets ke liye thoda negative ho sakta hai. Agar interest rates decrease hote hain, toh opposite asar ho sakta hai.

Fed Rate Decision ek bahut hi closely watched economic event hai, aur iska asar global financial markets par hota hai. Traders aur investors ko chahiye ke regularly economic calendar ko check karte rahein taki woh is tarah ke events ka sahi samay par pata laga sakein.

تبصرہ

Расширенный режим Обычный режим